This week we’re going to be looking at yet another phenomenon that forms part of digitizing your business.

Over the last three weeks we’ve been talking about digitizing the business from looking at the strategy, to digitizing the core business, and then moving on to finding new growth opportunities using digital. The fact of the matter is, most traditional industries have no more patterns of growth going forward. We can look at traditional industries like banking and insurance. A good number of the population is starting to get banked and many are getting insurance. Additionally, a lot of the population have access to telecom services. As a result, there is a new need to use innovation and digital to drive growth, so that the business can survive and find opportunities to secure sustained growth.

That’s the new topic this week, finding new growth opportunities using digital.

Now what does finding new opportunities using digital transformation mean? It basically means using innovation and design thinking, to come up with ways to leverage your current business infrastructure in ways that you couldn’t initially do before.

Example – Botswana Post

BotswanaPost – Poso Money

I’ll give an example of this using one of my favorite firms in the local stratosphere, Botswana Post. This firm was able to understand that as an organization, they had a large branch network across the country.

They also found that the majority of the population across the country was unbanked. As a result, they went into financial services, something that they had almost no business being a part of, and built Poso Money. This is a FinTech service that assists the unbanked in making payments across the country. This, ladies and gentlemen, is pretty much how you use digital and your current infrastructure to find new opportunities.

How to Digitize the Core Business

Audit

Now as a business, how can you be able to do this? We at Xavier Africa start with a full business audit. What does the business have? What capabilities does the business have? What are the key differential services we have? What do we do better than anybody else?

In the case of Botswana Post, for example, they had a large branch network that ran across the country, and a regular inflow of pensioners who came to collect their monies from these branches on a monthly basis. Subsequently, what they had to do was find out how to use digital to leverage these very same people to ensure that they get more business from them.

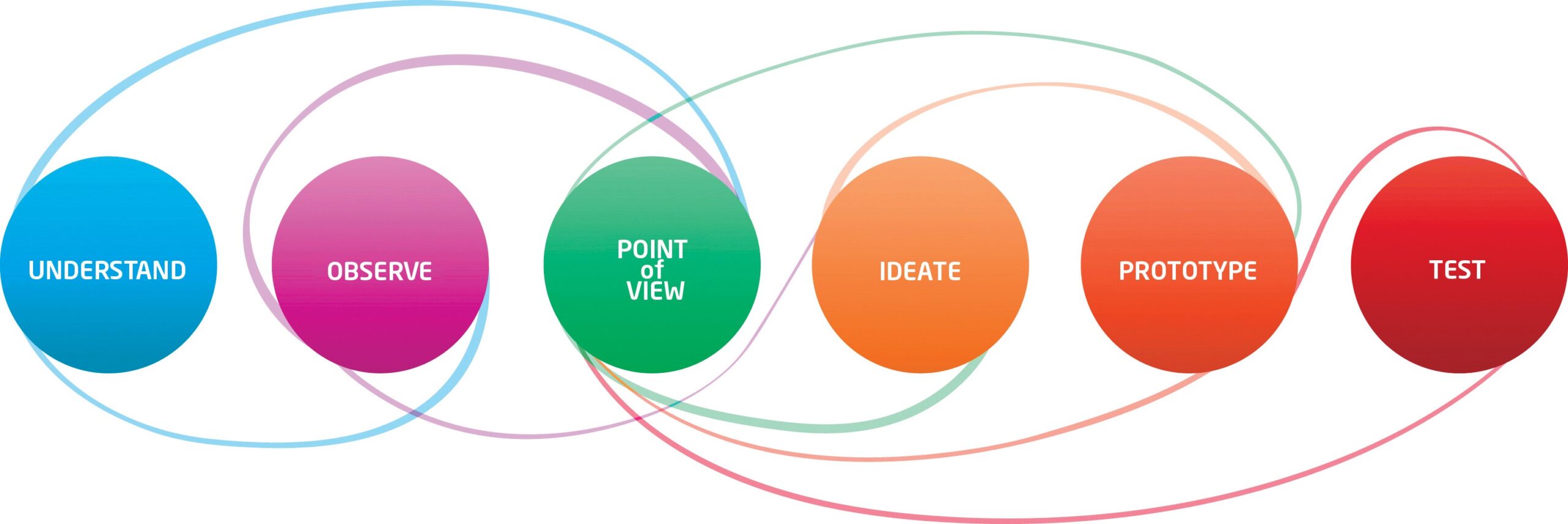

Design Thinking

Once the audit is done, we then look at how we use design thinking to make our customers’ lives easier. When finding new business opportunities, it’s important that you do not center everything around the initial product sold or service rendered. When looking at Botswana Post, if they had thought they were just a postal company, they wouldn’t have been able to go into fintech. Other companies, such as those in telecoms, have also gone into fintech. If they had only thought of themselves as telephone companies, they wouldn’t have been able to also find growth.

This is the same thing we have seen in different types of businesses across the world that failed to innovate and firmly stuck to only what they did in their core business. Therefore, it’s necessary that you divorce yourself and business from this mentality, and rather see your business as a vessel by which the market is served. Once you view your business as a vessel that serves your clientele and your client base, you will have the right mindset to build solutions that help them leverage their lives and improve the way that they live.

Explore New Growth Opportunities

The next and final step is to look at what kind of growth opportunities are currently available to you. What are the gaps within your current clients’ lives and how can you as a business use digital to leverage them? Here’s another example of an organization that we’ve worked with over the last couple of years. This organization is in the financial services industry, and what they do is provide loans to different companies across the country.

This company realized that a lot of their clientele didn’t have any online sales. Thus, they wondered how they could help them start doing online sales whilst also preserving their core business. So, even though they were not in the marketplace business, our client went on to build an online marketplace that allowed multiple small businesses –

– within their customer base to sell their products online. Then, they went on to build a payment gateway through which all the sales were made.

They understood that even though they were in the loaning business, their job was to ultimately make their clients’ lives easier. And for this new growth avenue, they receive approximately 5% of over P150,000 sales that are coming in on a weekly basis. This is a new revenue and growth model that they otherwise wouldn’t have been able to do without digital. And by leveraging it, they’ve been able to grow and build their business for more profitability, and to help them reach customers even beyond their current pool.

Conclusion

We have explored the two different types of ways your organization can be able to leverage digital, these being digitising the core business,, as well as finding new growth opportunities. This introduces a new layer of operationalizing these methods. When we started this series, we first started off by looking at how you create a strategy, and ensuring that it works for you digitally. We ventured into looking at the market that you’re operating within, digitizing the core business and finding new growth opportunities and the traps found in doing that. Now, we explore the actual operationalization of all of these things. How do we move this from just being conceptual and theoretical to operationalizing it and actually making it work? Over the next three to four weeks, we’re going to be looking at operationalizing digitization using what we call the core enablers.

These core enablers are the people in the organization, the processes within your organization, the ecosystems that exist around the organization, and lastly, the technology. We look forward to sharing the upcoming practical steps, and hope that you continue to engage with us. You may do so by calling us at 393 4045 or sending an email to admin@xavierafrica.com. Until next time, thank you for reading.